how to calculate a stock's price

You could either. The price of Stock A is expected to be 10500 per share in one years time P1.

How Do I Calculate Drift From A Series Of Stock Prices Personal Finance Money Stack Exchange

How Stock Prices Are Determined.

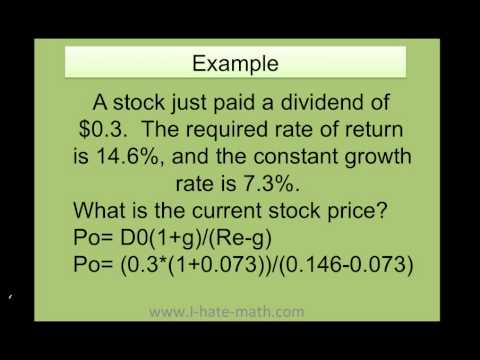

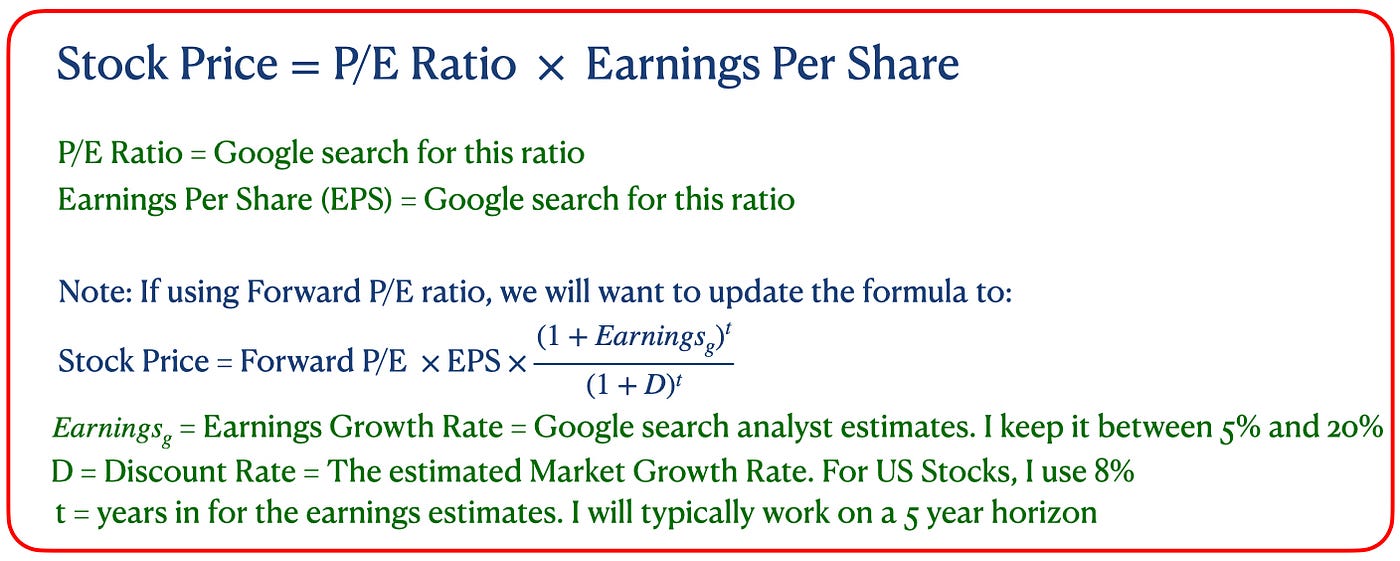

. Stock price price-to-earnings ratio earnings per share. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P Heres an example. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of.

We showcase both methods in great detail in our video on Calculating Stock Returns on Python Code-along viewable here. A startup has preferred stock that has an annual dividend of 3. Sign up now at TD Ameritrade.

Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100. The algorithm behind this stock price calculator applies the formulas explained here. You need to back into the price using the industry ratio as a threshold.

For example Facebooks target price for 2020 is. Price Target Current Market Price Current PE Forward PE. Divide the firms total common stockholders equity by the average number of common shares outstanding.

Price Estimated EPS Trailing PE where Price is the variable we are solving for. For an investor price target reflects the price at which he will be willing to buy or sell the stock at a particular period of time or mark an exit from their current position. Last 12-months earnings per share.

NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. Backed By 30 Years Of Experience. If you buy the stock at 3 the PE ratio.

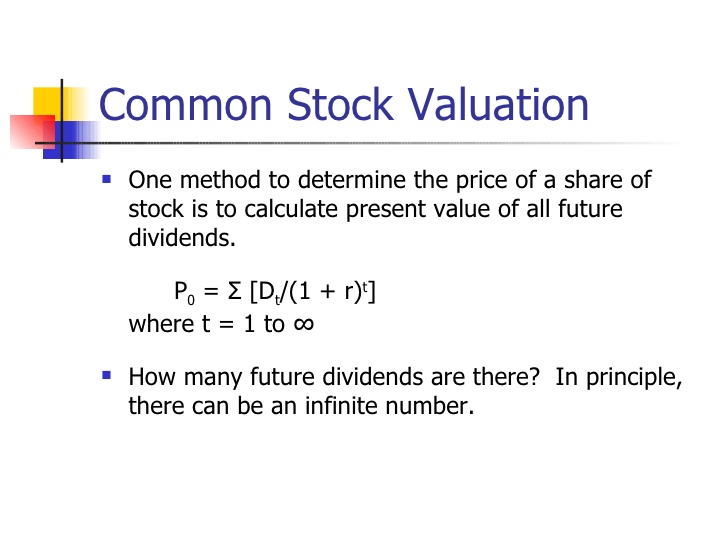

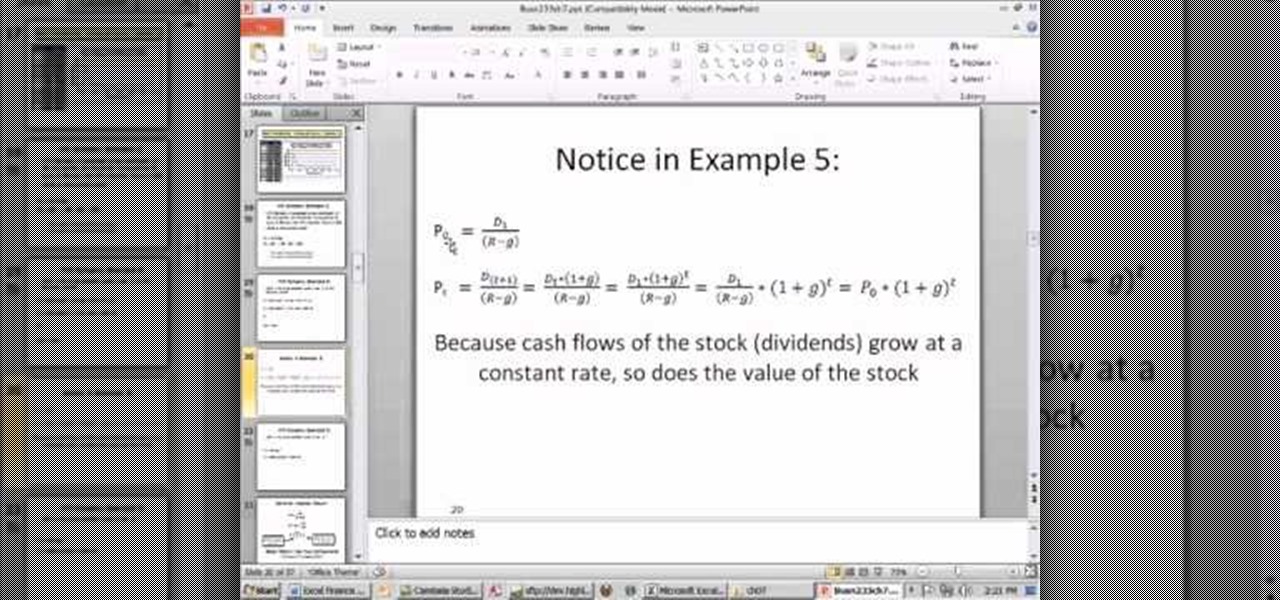

After shares of a companys stock are issued in the primary market they will be soldand continue to be bought and soldin the secondary market. P D 1 r g where. Ad Your Investments Done Your Way.

How To Calculate Stock Price With Formula Using Beta. Calculating Todays Stock Prices. The formula to calculate the target price is.

This will give you a price of 667 rounded to the nearest penny. Calculate stock returns manually by using the shift method to stack the stock price data so that and share the same index or. Ad Explore the Latest Features Tools to Become a More Strategic Trader.

Profit P SP NS - SC - BP NS BC Where. Assume you purchased the financial services stock with a PE ratio of 3 and now you want to calculate the best price to sell. Therefore our capital gain is.

Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future stock price is anyones guess. The Stock Calculator uses the following basic formula. Price 817 3289 where Price is equal to 26871.

Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B. By using the pct_change method. How to Calculate share value Example.

Calculate the firms stock price book value from the balance sheet. If the current stock price is 25 what is the cost of preferred stock. Heres an easy formula for calculating the value of the preferred stock.

Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate. Price of Stock A is currently 10000 per share or P0. Calculating the Sell Price.

Written by Noah March 14 2022 By dividing a securitys standard deviation of returns with a benchmarks standard deviation of returns Beta can be calculatedOn this basis the yield of an equity is multiplied by the return correlated with a benchmark. Unique Tools to Help You Invest Your Way. Substituting the values in the formula we get 33000500000100 66 Therefore Mark owns roughly 7 of XYZ.

These are easy formulas once getting the terminology down. Dividends are expected to be 300 per share Div. Book Value per Share.

Announces a 21 stock split. Smart Technology for Confident Trading. Ad Diversify and Manage Portfolio Risk with Liquid Options and Futures.

Cost of Preferred Stock D P0. Stock price fluctuations happen in the secondary market as stock market participants make decisions to buy or sell. In this case the adjusted closing price calculation will be 20 1 21.

We can rearrange the equation to give us a companys stock price giving us this formula to work with. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63. Annual Dividends per share.

Keep in mind that equity is not just comprised of common stocks. In this case that threshold is 10 and earnings per share have been at 1.

How To Calculate Future Expected Stock Price The Motley Fool

Present Value Of Stock With Constant Growth Formula With Calculator

The Stock Price Of Retro Co Is 65 Investors Required A 12 Percent Rate Of Return On Similar Stocks If The Company Plans To Pay Dividend Of 3 80 Next Year What Growth

How Is A Company S Share Price Determined India Dictionary

How To Find The Current Stock Price Youtube

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

How To Calculate Weighted Average Price Per Share Fox Business

How To Calculate Future Expected Stock Price The Motley Fool

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

How To Calculate Weighted Average In Stock Valuation Rakub Org Bd

How To Find The Current Stock Price Youtube

Common Stock Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

How Is Market Price Per Share Calculated Quora

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)